What Are Financial Instruments

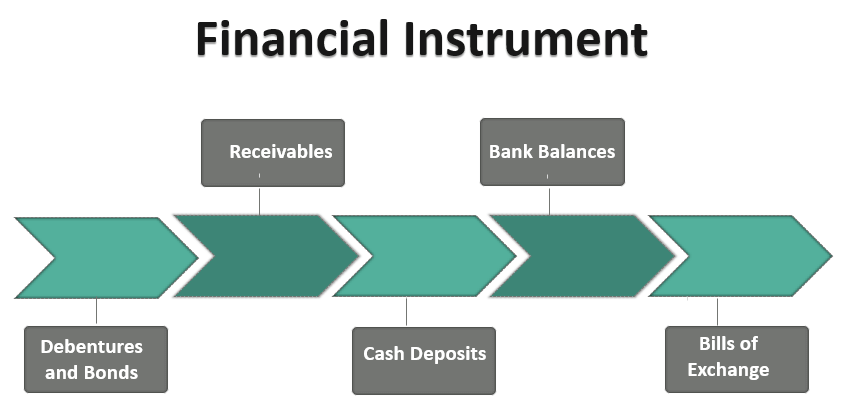

Financial instruments are financial assets that represent a claim on some underlying asset or entity. They are used to facilitate financial transactions and to manage financial risks. Financial instruments can be classified into two broad categories: debt instruments and equity instruments.

Debt instruments, also known as fixed income securities, are financial instruments that represent a loan from the issuer to the holder. Examples of debt instruments include bonds, loans, and mortgages. Debt instruments typically pay a fixed rate of interest to the holder and are backed by the issuer’s promise to pay back the principal at a later date.

Equity instruments, also known as stocks or shares, represent ownership in a company. Examples of equity instruments include common stock, preferred stock, and options. Equity instruments give the holder a share of the profits and losses of the company and give the holder certain rights, such as the right to vote on important company decisions.

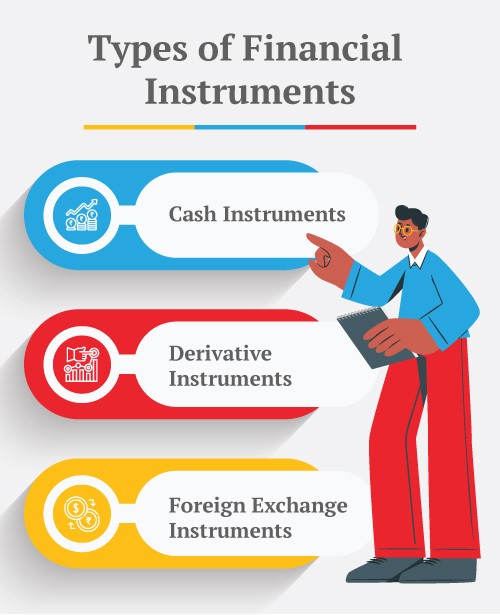

Types of Financial Instruments

There are many different types of financial instruments, each with its own unique characteristics and risks. Some common types of financial instruments include:

- Money market instruments: These are short-term, low-risk financial instruments, such as certificates of deposit (CDs) and commercial paper, that are used to raise funds in the money market.

- Derivatives: These are financial instruments that derive their value from an underlying asset, such as a commodity or currency. Examples of derivatives include futures, options, and swaps.

- Investment instruments: These are financial instruments that are used to invest in various asset classes, such as stocks, bonds, and real estate. Examples of investment instruments include mutual funds, exchange-traded funds (ETFs), and individual securities.

- Insurance instruments: These are financial instruments that are used to transfer risk from one party to another. Examples of insurance instruments include life insurance policies, property and casualty insurance policies, and health insurance policies.

Conclusion:

In conclusion, financial instruments are financial assets that represent a claim on some underlying asset or entity. They are used to facilitate financial transactions and to manage financial risks. Financial instruments can be classified into two broad categories: debt instruments and equity instruments. Debt instruments represent a loan from the issuer to the holder, while equity instruments represent ownership in a company. There are many different types of financial instruments, each with its own unique characteristics and risks, including money market instruments, derivatives, investment instruments, and insurance instruments.